AI Without Compliance:

A Cautionary Tale of FTC Enforcement

First, software was eating the world; now, it’s supposedly AI – or the data used to create that AI – that’s eating the world. Either way, the market for products and services powered by machine learning and artificial intelligence is hot, with even “traditional” companies and industries realizing the benefits of these technologies.

Ever the trend-follower, the FTC has also taken notice of these areas (*cue the dramatic music*). In the past two years, they have increased their focus on both AI companies specifically and data companies generically. While it’s clear that the FTC isn’t diving deep into the architecture of transformer models or MLOps platforms, they are developing a high-level understanding of how companies acquire data and use this data to train models variously described as machine learning, deep learning, NLP, or AI.

As the FTC’s attention and insight have grown, they’ve become more aware of how issues with data collection and acquisition interact with their jurisdiction – especially as it relates to privacy and consumers’ rights. Today’s post will cover some recent developments in FTC oversight and enforcement, as well as how organizations can avoid, identify, and mitigate the risks related to “tainted” models.

Federal Trade Commission

Oversight

The FTC is responsible for enforcing over 70 different laws, but they’re best known for their purview over unfair or deceptive practices. When applied to the area of machine learning, they generally focus on whether companies are utilizing consumer data in unfair or deceptive ways. Oftentimes, this means that the FTC investigates whether companies violated federal regulations related to the collection and use of consumer data.

There are multiple federal regulations that govern the collection and use of consumer data: the Children’s Online Privacy Protection Act (COPPA), for example, requires notice and verifiable parental consent prior to the collection, use, or distribution of children’s data. The FTC is able to directly fine organizations for failure to comply with COPPA; in addition, they can work with the courts to impose additional penalties.

B2C Only? Or B2B Too?

Many companies in the B2B space have historically ignored the FTC and its Bureau of Consumer Protection; if the FTC does cross their radar, it’s typically because the Bureau of Competition is involved, like in the case of a Hart-Scott-Rodino (HSR) review prior to closing a business combination.

Increasingly, however, the FTC and some courts have begun to apply “consumer protection” concepts to B2B relationships. In the context of machine learning, these causes of action are often supplemental to traditional breach of contract claims like confidentiality and purpose of use; that said, they do evidence an increasing risk for companies that “push the boundaries” of their data acquisition strategies. For B2B companies doing business in the UK and EU, the headwinds blow even stronger.

Increased Scrutiny and Settlements

When it comes to consumer data, the FTC has clearly been stepping up its focus on illegal collection. But in many cases, companies didn’t stop at collection; they went on to use that illegally-collected data for other purposes. Sometimes, those purposes were themselves illegal ( i.e., “illegal use”); in other cases, while the purpose of use was not prohibited, the initial collection or other practices arguably tainted “downstream” IP.

One recent example of this latter category occurred in Weight Watchers/Kurbo’s (now just “WW”) settlement with the FTC. While there was nothing inherently illegal about a weight loss application using machine learning to customize programs, they violated the COPPA when they failed to properly obtain parental consent for the collection of children’s data.

Some companies view fines with a risk-based approach: how do the penalties compare to the potential revenue generated by the wrongdoing? This approach may no longer be viable, as the FTC seems to be catching on to this incentive dilemma, and they’ve got a new tool in their enforcement arsenal.

Algorithmic Disgorgement

Simply put, the FTC needed to change the “expected value” of the non-compliance strategy, as companies continued to skirt the rules, knowing that even if they were caught, it was still an “NPV-positive” decision. Penalties, while a disincentive, weren’t enough to outweigh the value of the IP created.

So, what’s the easiest way to change that? Take away the IP. Blow it up. Put it in the trash. Make them watch it burn.

The FTC’s attorneys are a little more serious than we are though, so they picked a technical term – disgorgement. Disgorgement is often used as an equitable remedy to prevent unjust enrichment: it most typically requires a party who profits from an illegal act to give up any profits arising out of that act.

In the case of algorithmic disgorgement, the FTC went back to its original meaning under Black’s Law Dictionary – “the act of giving up something.” In essence, algorithmic disgorgement requires the offending party to delete or destroy any algorithms, models, or other work product or IP derived from or trained on ill-gotten data.

While the FTC has only required algorithmic disgorgement twice previously, both of these have occurred in the past year. In 2021, the FTC required Everalbum to delete the facial recognition models and algorithms that had been built using customer data after they failed to properly obtain consent.

These two cases serve as a warning to organizations: building and training models on tainted data opens the door to serious FTC actions. The frequency of settlements involving algorithmic disgorgement are almost certainly going to increase in the near future.

Why Does this Matter?

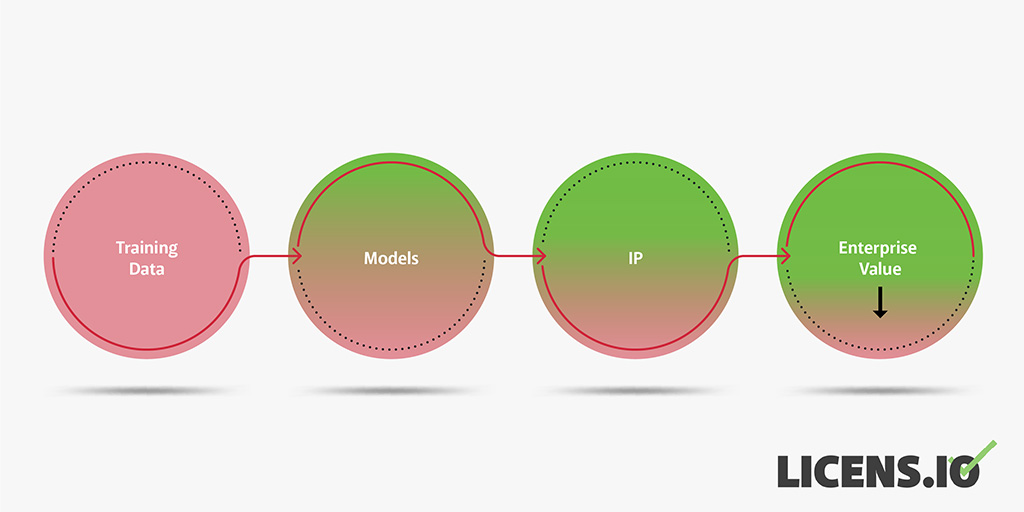

Companies often spend months to years building machine learning models and launching them into production. But if the rights to collect and use the training data weren’t secured or documented, what happens to that investment?

The FTC has now demonstrated that such investments can become complete write-offs in the blink of an eye.

The impact of tainted data flows through an organization.

Writing off valuable IP assets and removing product functionality is likely to leave an even bigger mark on the operational and strategic picture; the operational efficiency of many companies today is based largely on their technology-enablement through machine learning. What happens to their labor costs and valuations when that technology is disabled?

For many single-product or API companies, these risks are existential.

Help! How Do I Avoid This?

For Companies and Founders

If you’re building machine learning models, start with the data. Where did it come from? Does your organization have someone you can talk to about your contracts or applicable laws? Just like good code, documenting your findings and decisions at this stage is critical.

For organizations that create many machine learning models or frequently iterate and enhance on key models, information systems dedicated to tracking your training data might be good investments. Luckily, many MLOps platforms can track the provenance and metadata that supports this compliance. But, as always, it’s a garbage-in, garbage-out situation. If the systems of record upstream from your training data don’t collect critical information like consent, then there’s no way to track this downstream in your training artifacts.

Strong data protection policies and related procedures also help ensure that no tainted data ever enters a training set or leaks to an unauthorized party. If you do discover that models essential to your operations contain problematic data, redevelopment of the models is often the best solution.

The best time to ensure compliance is always yesterday. But if you’re thinking about raising capital or selling your company or assets, then today is a great time to start. Don’t hesitate to reach out to see how our assessment or diligence preparation teams can help.

For Investors or Acquirers

If you’re investing in or acquiring a company whose value is predicated on their models or ML/AI/data science capabilities, then it’s essential to do proper technology due diligence. Sometimes, the assessment focuses on specific machine learning models; other times, it focuses on a target organization’s overall data science maturity level. In addition, the underlying policies, procedures, and systems related to information security, data protection, and data privacy are also key drivers of future risk. AI companies stuffed full of data often make attractive targets for threat actors looking to profit from stolen data.

In practice, most investors or acquirers today simply rely on representations and warranties to shift the burden of this risk. But, as the FTC’s recent WW case demonstrates, reps and warranties will only get you so far. If your business scales or integrates the IP of an acquired company, the impact from penalties or disgorgement could significantly exceed the R&W caps in your purchase agreement.

Our recommendation is to address these risks head-on in diligence. While this process was historically time-intensive, we’ve luckily automated much of the process through our diligence platform, which additionally includes data collected from hundreds of thousands of open source software projects and compliance outcomes. If you’re interested in learning more about how we can help provide diligence or advisory services, please get in touch with us.