FUNDRAISING 101:

EQUITY VS. DEBT

What is Capital?

Within finance, capital refers to the corporate securities that have been issued. The term “securities” is broad in this case, including the two types of capital that we’ll be discussing today: debt and equity.

Debt

A debt instrument represents money borrowed by one party – the “debtor” – from another party – the “creditor” – with the obligation to repay the loan. In general, the repayment of the loan must include interest or finance charges in addition to the amount borrowed.

There are numerous ways to categorize debt. Some of the more common classifications are:

- Secured vs. unsecured

- Revolving vs. term

Secured

Secured debt is backed by collateral – assets that are pledged. The creditor places a lien on the asset so that in the event of the debtor’s default on the loan, the creditor can take possession of the collateral and sell it to recover the debt.

Unsecured

Unsecured debt is not backed by specific collateral. As a result, creditors impose a higher interest rate on the debt to address the fact that, in the case of a default, they do not have recourse against the debtor until they have filed a judgment against them.

Revolving

Think credit card here. Revolving debt does not have pre-determined payment amounts. Debtors can borrow any amount up to the approved limit and can repay all or a portion of the borrowed amount, with interest charged on the outstanding balance.

Term

Debtors borrow a specified amount of money for a specified duration. While there may be an option for early repayment, the note will specify how and when payments will be made.

Equity

Equity is a security that represents ownership of a business and grants the equity holder certain rights. There are many types of equity securities, including:

- Shares

- Warrants

- Options

Shares

Shares are units of ownership of corporations. They can be further classified as common or preferred shares. The rights associated with each class of shares may differ with respect to factors such as voting rights, dividend preferences, and dissolution preferences.

A note about warrants and options: the commonly accepted definitions of warrants and options can vary based on the context in which they’re being used.

Warrants

Startup definition: Warrants confer the right, but not the obligation, to purchase a company’s shares, typically as part of in commercial and financial transactions.

Public market definition: Warrants confer the right, but not the obligation, to purchase a company’s shares from the company.

Options

Startup definition: Options confer the right, but not the obligation, to purchase a company’s shares, typically to external service providers (i.e., contractors) and employees.

Public market definition: Options confer the right, but not the obligation, to purchase a company’s shares from someone other than the company itself.

Convertible Debt

Convertible debt begins as a loan, and upon an agreed upon condition or trigger, can be converted into equity. In the startup space, these are often used to bridge the time between when a company’s runway ends and when they secure funds from their next round of financing (although in some cases companies use them in lieu of an equity raise). In effect, the convertible loan allows investors to lend money now, with the option to convert the repayment into equity with the company (almost always at a discount).

Convertible debt kicks the valuation can down the road – no valuation is required at the time of the issuance of the convertible debt. However, given that convertible debt agreements often include a valuation cap, this does, in substance, set a price…it just does so in a less transparent manner.

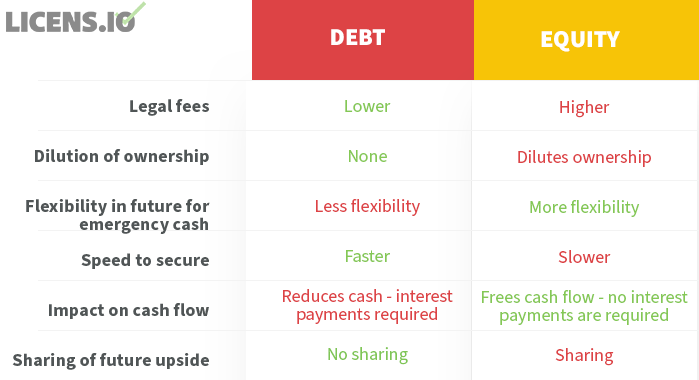

Debt vs. Equity

There’s no universal “right” answer when it comes to choosing between debt and equity (and, in some cases, companies will raise through both debt and equity during the same fundraising round). What’s most important is that companies’ leadership considers the short-term and long-term implications of raising through debt or equity: future fundraising, projected cash flows, and strategic planning should all be factored into the decision.

Our next post will discuss debt financing more in depth, specifically with respect to how tech companies can leverage their intangible assets to secure loans.