SECURING DEBT WITH INTANGIBLE ASSETS

Why Debt?

In early-stage companies, debt financing is often only used in the specific context of convertible loans. Traditional debt financing can be tough for companies that are in a growth stage, as many are either pre-revenue or focus on reinvesting revenue in growth, not servicing debt. Conversely, for companies that have free cash flow sufficient to cover interest payments or a future balloon, but not enough to fund a large-scale expenditure, debt may be a preferred option.

Debt is generally preferable to founders who don’t want to dilute their ownership, and many are willing to sacrifice a fixed cash outlay in exchange for keeping the upside potential of their equity. In particular, when founders perceive a short-term need for cash but anticipate a return on investment faster than the repayment of the debt, the cost of debt may be relatively low.

Types of Debt Financing

As we discussed in our last post, debt can be categorized in multiple ways. Today we’ll be focusing on the unsecured/secured distinction.

Unsecured Loans

Loans that are not backed by assets are referred to as unsecured loans. In order for an unsecured creditor to collect on a defaulted loan, they would need to obtain judgment against the debtor. To address the increased risk and difficulty of recovering the loan value, creditors generally offer worse terms for unsecured loans, such as through higher interest rates, shorter terms, or restrictions on borrowing purpose.

Companies will generally only obtain unsecured loans because they are unable or unwilling to provide assets to obtain a secured loan.

Secured Loans

In a secured loan, the debtor pledges assets as collateral, and the creditor places a lien on these assets. In most cases, specific assets are “pledged” by the borrower, such as real property like buildings, intangibles like patents, or even entire subsidiaries. If the debtor later defaults on the loan, the creditor has legal recourse to take possession of the collateralized assets.

Creditors offer lower interest rates on secured loans, although it often varies based on the type of collateral that’s been pledged. Generally, lenders prefer collateral that is easier to value and sell, especially if the lender is an entity subject to risk-weighted asset regulation like Basel.

Assets as Collateral

Accountants and lawyers love asset classifications. At the highest level, assets are either tangible (physical assets) or intangible (non-physical assets). While tangible assets can always be used to secure financing, intangible assets can only be used in certain circumstances.

Banks vs. Other Lenders

Banks are subject to regulatory requirements above and beyond many financial organizations. With respect to what assets can be used to secure loans, banks often do not accept intangible assets as collateral for loans.

While there are some industries for which this isn’t an issue (retail has inventory, manufacturing has equipment), the modern era of industry is heavily digital. If you think about your own company, what tangible assets do you have? For many companies today, the only assets in this category are laptops or monitors. Even if organizations are not fully remote, many lease their office space and therefore don’t have title to any real property in the form of buildings or land.

Specialty lending and financing companies are often the best fit for companies whose collateral is in intangibles. These companies generally focus on lending against a specific type of collateral, like IP, and are designed to operate outside of risk-weighted asset regulation frameworks.

Assessing Your Intangibles

Step 1: Discovery + Inventory

Before you can obtain secured debt, you’ll need to know what assets you own. Conducting an inventory of your tangible and intangible assets can be done manually, especially if it’s fairly limited. For larger, more established, or more distributed companies, automated solutions can help ensure that you don’t overlook forgotten or hidden assets.

Common tech intangibles include:

- Trademarks

- Patents

- Source code

- Machine learning models

- Data

- Domain names

Step 2: Confirm Ownership

Given that the entire reason for securing an interest in property (even intangible property) is to ensure that the creditor has a way of recovering the value of a loan that defaults, it’s essential that debtors actually own the intangible assets. If clear title or ownership rights can’t be established due to omitted or contradictory contract terms, then organizations can find themselves up a creek – both for borrowing and for future M&A transactions.

Step 3: Valuation

What are your assets worth?

There are varying ways to determine what an asset is worth. Some factors to consider in answering this question are:

- What was the actual cost to produce it (i.e., the historical cost)?

- How much would someone spend to create this asset today (i.e., the cost to rebuild)?

- How much would someone be willing to pay to acquire this asset based on their business?

With respect to methods of valuing intangible assets, the most common approaches are:

Cost: there’s a tension here between what you historically paid to create an intangible asset (the historical cost) and what a creditor would be willing to pay to create the asset today (the cost to rebuild). Ultimately, the creditor isn’t going to care about your sunk costs – the cost to rebuild it today is a much more relevant metric in their assessment of the value of the asset you’re pledging as security.

Market: this approach uses market information on comparable assets to determine what they’re “worth.” If you’re in a particularly niche area or have created intangible IP that is so significantly different from what’s already out there, it’s likely that many adjustments will be made to the market comps to account for these.

Income: this method discounts the future cash flows (income) that is expected to be derived from your intangible assets to arrive at a present value of the asset(s). If you’re pre-revenue, this may be based on industry benchmarks and sales projections.

Trade Secret Considerations

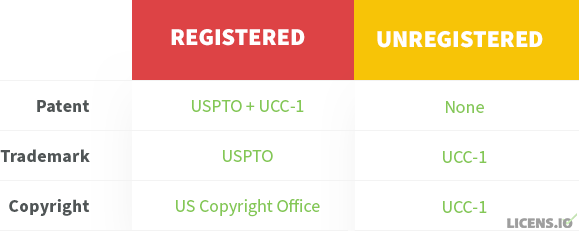

Creditors who lend with intellectual property as collateral generally perfect their security interest, as neglecting to do so significantly decreases their ability to recover the value of defaulted loans.

Creditors perfect their security interest by registering or filing their interest with the appropriate regulatory body. The specifics vary depending on the type of intellectual property and whether it has been officially registered:

The UCC-1(Uniform Commercial Code-1) statement is a document filed by a creditor to publicly declare their priority in collection rights in the case of a default.

Companies that are looking to secure their loan with unregistered intellectual property will often find that the lender requires them to register the intellectual property with the appropriate federal office. This may be a mere inconvenience for something like a trademark, but for copyright, it can obliterate an entire business strategy. Most software companies treat their source code as a trade secret, and protect it from access by competitors or threat actors. By registering the code with the US Copyright office, competitors can gain insight into features and can find different means to achieve the same ends. In the same way, malicious actors can more easily identify vulnerabilities to exploit. (As a side note, we don’t recommend security through obscurity alone as an infosec strategy.)

So, if you intend to use your software as collateral for a secured loan, keep in mind that your lender may require copyright registration of the source code. For companies who wish to maintain their code or machine learning models as a trade secret, other intangible assets may be a better choice for securing the loan. In some cases, borrowers can assign their IP to a holding subsidiary and collateralize the subsidiary, which provides many of the same benefits as well as additional regulatory flexibility. In some cases, alternative lending models outside of the “traditional loan” space are a better fit for companies light in tangible assets, but who don’t want to complicate their org structure or IP management for the sake of financing.

Moving Forward

Whether or not you decide to move forward with debt financing secured by intangible assets, the steps and considerations that are involved in the process can be valuable to your organization. Identifying your intangible assets can lead you to realize that you have some that are completely unutilized and should be strategically repositioned to capture value; or perhaps the discussions surrounding whether or not to register your source code with the US Copyright Office lead to changes to the way your company maintains its competitive edge. At a high level, these situations are all looking at the same idea: how to make your intangible assets work for you.

As part of our technology assessments and diligence engagements, we identify intangible assets for companies (even those abandoned ones that you’d forgotten about!) While this process was historically time-intensive, we’ve automated much of the process through our Dilligencer™ platform. If you’re interested in compiling an inventory of your intangible tech assets or developing a strategy to better maintain or utilize them, let’s connect.